Table of Contents

Stock market index meaning.

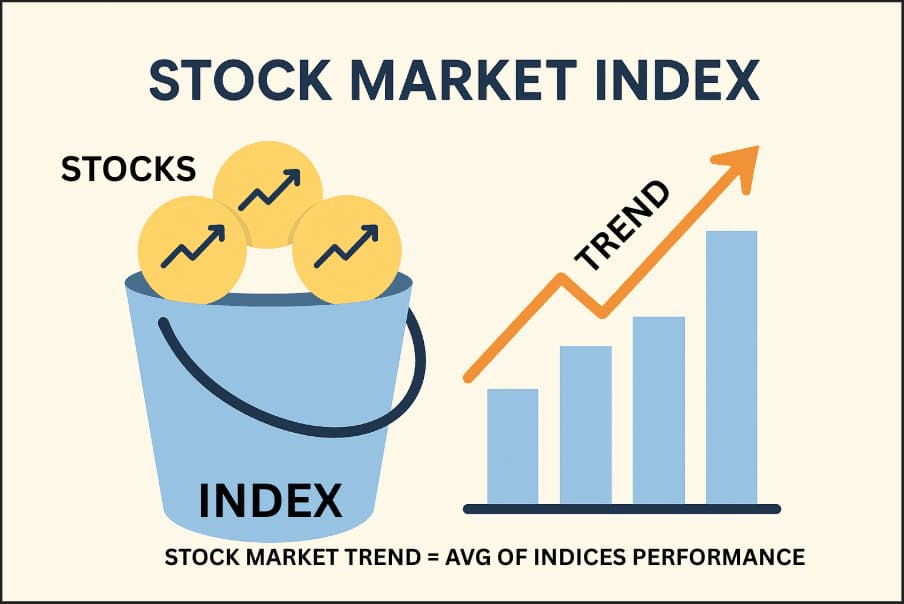

A stock market index is like a representation of a particular country’s share market trend. It shows the average of the performance and the direction of the entire market’s sentiment. In simple terms, we can say an index tells us about current trend of the equity market of the country: Uptrend or Downtrend.

For better understanding, lets assume a country’s stock market have more than 1000 of listed companies in it. So it will not be easy for someone to analyze all the stocks to identify the current trend or direction of market. But if the market regulators created two indices of 500 stocks each and those indices move an average of all the stocks they consists, it will be a lot easier for us to just check out those two indices to analyse the trend of the market because they are average of the stocks.

Difference between individual shares and a stock market index. Are they same?

As the name suggests, a stock and a stock market index are not the same, they are two different things. Here are few differences to understand better-

- A stock is an entity of a individual/single company, while an index is consists of more than 1 company’s stocks.

- Stocks just belong to a single company of any specific sector, but the index can be made of all or top companies of the complete sector. For example: NIFTY Bank and Nifty IT represent the performance of entire Banking and IT sectors.

- There are other indices based on the market capitalization of the companies, unlike the individual stocks. For example: NIFTY SMALLCAP 250 and NIFTY MIDCAP 100 are the indices of top 250 smallcap and 100 midcap companies.

How is it calculated? Criteria for NIFTY 50.

NIFTY 50 is the among the most famous and successful indices. It is the collection of top 50 companies of the National Stock Exchange. So its a obvious question that how a stock is eligible for entering into this index. Well here are some pointers that will allow you to understand the selection process of the companies for the NIFTY 50 –

- Company’s should be from Indian origin and listed into the NSE.

- Company’s stocks should be available in futures and options for trading.

- There should be high liquidity in the stock and the impact cost for the execution of the securities transaction should 0.50% or less in previous 6 months.

- In last 6 months, company’s trading frequency should be 100%.

Types of stock market index. Factors of formation?

In simple language, there are multiple types of stock market index and multiple factors and criteria for their calculation. Here are few of those types

Benchmark/condition based index

Those stocks who passes or fulfilled a predefined benchmark or criteria or condition may be a part of the benchmark indices. Here are few famous benchmark based indices- NIFTY 50, NIFTY 100, NIFTY 500, SENSEX, S&P BSE 100 and S&P BSE 500 etc.

Sector based indices

An index can be based on a specific sector. Those are called sectoral index or sector based index. For example – NIFTY Bank, NIFTY IT, NIFTY PHARMA, NIFTY AUTO, NIFTY FMCG and so on.

Market capitalization based index

As the name already saying these indices are based on the criteria of market capitalization. Irrespective of the large capitalization, these indices can be based on the mid cap and small cap also. Here’s the example – NIFTY SMALLCAP 100, NIFTY MIDCAP 100, NIFTY SMALLCAP 250, NIFTY MIDCAP 50 and so on.

How to trade and invest in an Index?

If we want to trade in a stock market index then it is possible through the options and futures. We can trade in the futures and options contracts of the selected index. But unlike the other individual stocks, an index can not be bought or sold for the investment. Because an index is neither like a individual company nor it has the fixed number of shares.

A index is bought or sold or traded in contracts. We can do that with our respective broker if they allow this segment. There multiple discount broking apps like- ZERODHA, UPSTOX, GROWW, ANGLE ONE and others.

But always keep in mind that trading or investing in stock market is subjected to risking your money. So please do your research before investing or trading and always prefer learning before actual trading.

That’s all folks for the article. If you found some really valuable information about indices and learnt something about stock market then consider supporting us.

Thank you for giving your valuable time reading this article.

Abhinav Sharma

Pingback: Diversification in Stock Market. Meaning, Types, Advantages

Pingback: Stock Market impact amid India-Pakistan Conflict. What next?

Pingback: Powerful Investing in Stocks for Beginners. Authentic Guide